Just days after Wing and Walmart launched drone delivery in parts of Greater Houston, competitor Zipline announced plans to enter Houston as well — along with Phoenix. In addition to revealing its new expansion plans, Zipline also revealed it has now surpassed 2 million commercial deliveries and raised more than $600 million at a $7.6 billion valuation.

Taken together, the timing is not a coincidence. Houston looks to be the proving ground for the next phase of U.S. drone delivery, where multiple operators are no longer testing viability — they’re competing for scale.

And Zipline’s announcement is notable not just for its funding or delivery milestones, but for what it represents: drone delivery in the U.S. is shifting from isolated pilots into a competitive logistics market, with different business models racing toward the same goal.

Two Houston launches, two very different approaches

Wing and Zipline have arrived in Houston in early 2026 with fundamentally different strategies.

Wing’s Houston rollout is tightly integrated into Walmart’s existing retail footprint. It’s focused on small, urgent items — eggs, baby wipes, over-the-counter medicine — delivered from nearby Walmart Supercenters to surrounding neighborhoods. Packages are limited to about 2.5 pounds, and the service is designed to supplement, not replace, traditional delivery.

Zipline, by contrast, is positioning itself as a broader autonomous logistics platform. In Houston and Phoenix, the company says customers will eventually be able to order tens of thousands of items through its own app, with deliveries arriving in as little as 10 minutes. Zipline emphasizes speed and volume, citing a median flight time of three minutes and rapid ramp-up at new sites.

Where Wing leans on Walmart’s density, Zipline leans on its own infrastructure and years of experience delivering medical supplies at scale — particularly outside the U.S.

Houston may turn out to be the true test of which approach resonates more with American consumers. Or hey, maybe both do.

Putting Zipline’s drone delivery numbers into ontext

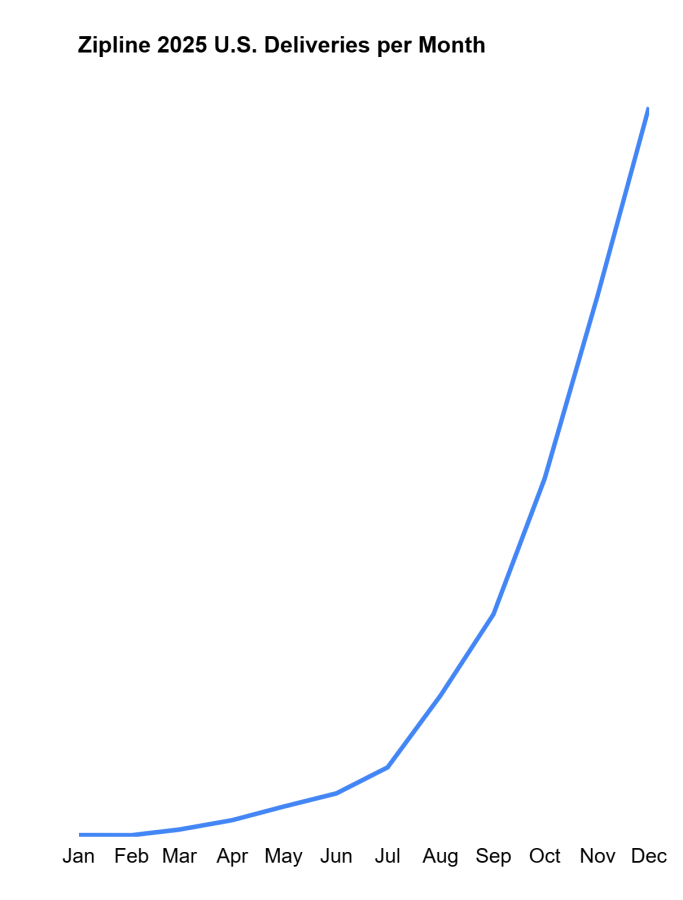

Zipline’s milestone of 2 million commercial deliveries is significant, especially compared with other drone delivery operators. The company also claims its U.S. deliveries have grown roughly 15% week over week for seven months, an eye-catching figure that suggests accelerating demand. Check out this chart provided by Zipline to The Drone Girl:

To see its U.S. drone deliveries growing so much over the past year is key.

Over the previous decade or so, much of Zipline’s historical success had come from healthcare logistics, particularly in developing countries where road infrastructure was limited and drones filled an essential gap. Consumer retail delivery in dense U.S. suburbs is a very different challenge, shaped by regulation, noise concerns, property rights and customer expectations.

The success of Zipline’s Houston effort will be a key proving ground. Can Zipline translate its global logistics experience into repeatable, everyday consumer behavior in American neighborhoods? Or will drone deliveries be more of a novelty or one-off use?

For what it’s worth, this is also a massive growth year for competitor Wing, which has plans to bring its service to over 40 million Americans across major metros including Los Angeles, Miami, St. Louis and Cincinnati. And Wing data suggests that its customers don’t just perceive drone delivery as a novelty. According to Wing, its top 25% of customers order three times per week.

The post Zipline’s Houston move signals drone delivery’s competitive phase appeared first on The Drone Girl.