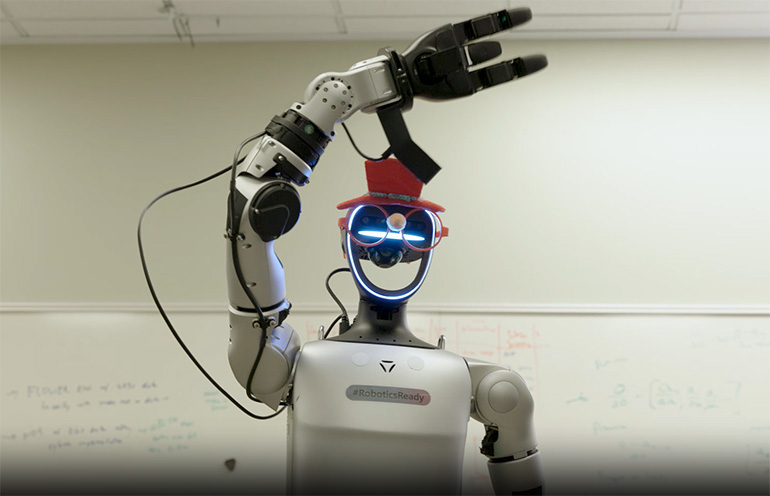

LivsMed has partnered with Sovato on telesurgery. Source: LivsMed

LivsMed LLC last week said it has completed an initial public offering, or IPO, on Korea’s KOSDAQ market. It raised about ₩135.9 billion ($94 million U.S.) at ₩55,000 per share, bringing its market capitalization to ₩1.4 trillion, or approximately $1 billion, making it a medical technology “unicorn.”

The company said it will use the proceeds to build an integrated production base, fund research and development, and strengthen related management systems to support global growth across its product portfolio.

“As we scale globally, we remain focused on making advanced surgical capability more accessible,” said Jung Joo Lee, Ph.D., founder and CEO of LivsMed. “An innovation cannot be called an innovation unless it can reach the masses.”

LivsMed develops systems for minimally invasive procedures, and collaborates with physicians worldwide to improve patient outcomes and expand access to advanced surgical capabilities. The company is headquartered in Seoul and has a U.S. subsidiary in San Diego.

Roadmap includes robots for the U.S., laparoscopic instruments

In July 2025, LivsMed demonstrated the capabilities of its STARK surgical robot in an early feasibility wet-lab study conducted with telesurgery platform provider Sovato. In the demo, the surgeon console was located in Santa Barbara, Calif., while the robotic system was in Chicago, supporting long-distance connectivity.

The STARK robot-assisted surgical system is not yet approved for use and is not for sale in the U.S.

LivsMed also plans to expand its portfolio of products for minimally invasive surgery. Launched in 2018, ArtiSential is a line of fully articulating handheld laparoscopic instruments designed to provide wrist-like dexterity.

The company has expanded its platform with ArtiSeal, a 90-degree articulating vessel sealer that it said enables multi-angle access in confined anatomy.

LivsMed draws global investment

LivsMed said its IPO drew significant interest from major domestic pension funds and institutions, as well as large global financial institutions headquartered in New York and Boston. During institutional book building, the company reported demand of roughly 231-to-1, with overseas participation representing 8.2% of the institutional demand, including investors from the U.S., the Middle East, and Asia.

On its market debut, LivsMed shares opened more than 10% above the offering price, which it said reflected positive initial market reception. Samsung Securities and Mirae Asset Securities served as joint lead underwriters.

The dollar equivalents provided above used an exchange rate of ₩1,445 per $1 as of Dec. 24, 2025.

The post LivsMed completes Korean IPO to accelerate remote robotic surgery appeared first on The Robot Report.